Translate this page into:

Out of Pocket Expenditure Among Patients Covered Under Voluntary Health Insurance for Kidney Replacement Therapy in a Tertiary Care Teaching Hospital in Coastal Karnataka

Corresponding author: Akshaya Sekar, Department of Community and Family Medicine, All India Institute of Medical Sciences Madurai, Tamil Nadu, India. E-mail: akshayasekar1991@gmail.com

-

Received: ,

Accepted: ,

How to cite this article: Sekar A, Kumar A, Shetty A, Jahan A, Kini B S, Daya A P, et al. Out of Pocket Expenditure Among Patients Covered Under Voluntary Health Insurance for Kidney Replacement Therapy in a Tertiary Care Teaching Hospital in Coastal Karnataka. Indian J Nephrol. doi: 10.25259/IJN_277_2024

Abstract

Background

Chronic kidney disease (CKD) is a global health concern and is associated with high cost of care. This study aims to evaluate the out-of-pocket expenditure (OPE) among CKD patients covered by voluntary health insurance (VHI) for kidney replacement therapy (KRT) services and assess their knowledge and satisfaction with existing coverage.

Materials and Methods

Data were collected from 68 patients covered by 14 VHI schemes. Sociodemographic characteristics, morbidity details, and health insurance specifics were analyzed using SPSS software. Statistical tests, including Chi-square and Mann-Whitney U, were used to assess associations and median satisfaction scores.

Results

Significant differences were found between government and private health insurance companies regarding morbidity (X2=8.094, p=0.004) and annual family income (X2=5.057, p=0.03). Statistically significant variations (p < 0.001) were also observed in policy type, beneficiary type, annual premiums, coverage amounts, enrollment duration, and frequency of hospital admissions. OPE showed no significant difference. Satisfaction scores for reimbursement and affordability were high but not statistically significant. Many participants lacked awareness about aspects of their health insurance policy, regardless of the provider.

Conclusion

Despite VHI coverage, CKD patients undergoing KRT experience substantial financial burden. Improved patient education and policy transparency are essential to address gaps in coverage and alleviate financial strain. These findings underscore the need for policy reforms and patient-centered interventions to enhance healthcare access and affordability for CKD patients in India.

Keywords

Voluntary health insurance (VHI)

Out-of-pocket expenditure (OPE)

Dialysis

Introduction

Chronic kidney disease (CKD) is characterized by progressive damage to the kidneys, ultimately resulting in kidney failure, which necessitates kidney replacement therapy (KRT). CKD is the seventh most prevalent cause of death globally and is rapidly rising in prominence.1 In India, the prevalence of CKD is approximately 14%, with 7% of participants having CKD stage 3 or worse.2 Although the exact number of patients receiving dialysis in India is unknown, estimates suggest that the number of chronic dialysis patients was between 75,000 and 100,000 in 2012 and around 175,000 in 2018.3,4

Every year, about 220,000 new patients with ESRD are added in India, resulting in an additional demand for 34 million dialysis sessions.3 This procedure is known for its high treatment costs and the financial burden it places on patients and their caregivers. To make renal care services more accessible and affordable for patients below the poverty line, the Ministry of Health and Family Welfare launched the Pradhan Mantri National Dialysis Program (PMNDP).3 However, for patients above the poverty line, the options are limited to paying out of pocket or utilizing voluntary health insurance (VHI). Unfortunately, many individuals with VHI find their coverage inadequate, resulting in high out-of-pocket expenditures (OPE).

The high OPE results from the varying plans, procedures, exclusions, and coverage limits offered by public and private VHI providers in India. Differences in waiting periods, non-consumables, claims processes, cashless services, and co-payments among companies and plans complicate the selection of appropriate policies. Poor knowledge in this area can lead to inadequate coverage for KRT. VHI for CKD care, particularly for KRT services, requires attention, as these critical and often lifelong interventions still leave patients facing high OPE. This financial strain and stress can lead to difficult healthcare decisions and poor health outcomes.

Few studies have examined OPE among patients receiving KRT services in India. It is crucial for healthcare professionals and policymakers to understand patients' financial realities in order to create a more affordable, accessible, and patient-centered healthcare system, ultimately improving patient outcomes and reducing financial burdens. We assessed the OPE for patients covered by VHI offering KRT services.

Materials and Methods

A cross-sectional study was carried out at Kasturba Medical College Hospital, Manipal, Udupi, Karnataka, between September 2020 and 2022. A purposive sampling technique was employed. Inpatients, including both new and existing dialysis patients admitted for KRT services under any of the 14 VHI companies—comprising 5 government and 9 private health insurers empaneled by the hospital—were approached for the study. The patients who did not provide informed consent, had other concurrent illnesses or complications related to dialysis, were discharged or died within 24 hours of admission, were involved in medico-legal cases, or had exhausted their insured amount for that premium period were excluded. Out of 76 eligible patients, 68 enrolled in the study (2 declined consent, 1 faced a medico-legal case, and the remaining 5 exhausted their insurance coverage during the enrollment period).

A semi-structured questionnaire was administered to all study participants through face-to-face interviews, followed by telephone interviews after discharge, to gather patient information and satisfaction data. Informed consent was obtained prior to participation. The questionnaire consisted of two main sections: the patient proforma and the patient satisfaction questionnaire. The patient proforma included sociodemographic details, insurance information, admission details, and billing information. The first three sections were collected through face-to-face interviews, while billing details were obtained from the hospital's billing portal. The out-of-pocket expenses considered in this study were limited to direct costs incurred during inpatient hospitalization, such as medications used during the stay, room charges (including patient meals), diagnostic tests, consultation fees, procedure costs, and medical devices. Indirect costs, such as food for caregivers and attendants, transportation, and other caregiver expenses, were excluded. The patient satisfaction questionnaire included questions to assess participants' knowledge and satisfaction with health insurance offerings for KRT services. Patient satisfaction data were collected telephonically after discharge.

Permission was obtained from the medical superintendent, finance manager, and senior software developer of the hospital to access the billing portal for this hospital-based study. A list of inpatients admitted under the Nephrology department with the selected 14 insurance companies was obtained from the hospital's electronic health records every other day. Patient details were verified from case sheets, and those receiving KRT services were identified. Patients were approached on the second day of admission in their respective wards. Those meeting the inclusion and exclusion criteria were considered for the study. The objectives and purpose of the study were explained to the patients, and a detailed information sheet was provided. Written informed consent was obtained before data collection and study enrollment and ethical clearance was obtained.

Statistical analysis

The data collected were analyzed using IBM Statistical Package for the Social Sciences (SPSS) software version 25. Categorical variables were summarized using frequencies and percentages to describe the study participants’ sociodemographic characteristics and health insurance details. Chi-square test was used to assess associations between categorical variables, such as gender, age, occupation, comorbidities, annual family income, type of health insurance policy, and other insurance-related factors between government and private health insurance companies. Mann-Whitney U test was employed to compare median satisfaction scores for OPE between government and private VHI, as well as various health insurance service features, including reimbursement, affordability, likelihood to recommend the policy, and effectiveness of customer care services. A p-value of less than 0.05 was considered statistically significant for all comparisons.

Results

A total of 68 CKD patients admitted for dialysis services, covered by any of the 14 voluntary health insurance schemes, were recruited. Table 1 presents the basic sociodemographic characteristics and morbidity details of the study participants. Most government-insured participants (79.6%) were male, while the majority of private-insured participants (52.6%) were aged 41 to 60. Over half of the government-insured participants (53.1%) were aged 61 or older. Retirement was common among both groups, with 32.6% of government-insured and 42.1% of private-insured participants being retired. All government-insured participants had comorbidities, compared to 84.2% of private-insured participants. Diabetes, hypertension, and cardiovascular disease were prevalent comorbidities, with statistically significant differences observed between the government and private health insurance groups (p = 0.004). Government-insured participants were more likely to have lower incomes (p = 0.032).

| Variables | Type of VHI company | X2 value | P value* | ||||

|---|---|---|---|---|---|---|---|

| Government (n=49) | Private (n=19) | ||||||

| N | %* | N | %* | ||||

| Gender | Male | 39 | 79.6 | 4 | 21.1 | 0.03 | 0.95 |

| Female | 10 | 20.4 | 15 | 78.9 | |||

| Age category | 21-40 years | 6 | 12.2 | 0 | 0 | 3.522 | 0.17 |

| 41-60 years | 17 | 34.7 | 10 | 52.6 | |||

| ≥61 years | 26 | 53.1 | 9 | 47.4 | |||

| Occupation | Government employee | 2 | 4.1 | 1 | 5.3 | 5.296 | 0.50 |

| Private employee | 4 | 8.2 | 0 | 0 | |||

| Self employed | 7 | 14.3 | 6 | 31.6 | |||

| Home maker | 9 | 18.4 | 2 | 10.5 | |||

| Retired | 16 | 32.6 | 8 | 42.1 | |||

| Student | 1 | 2.0 | 0 | 0 | |||

| Unemployed (Unable to work) | 10 | 20.4 | 2 | 10.5 | |||

| Comorbidities | Yes | 49 | 100 | 16 | 84.2 | 8.094 | 0.004 |

| No | 0 | 0 | 3 | 15.8 | |||

| Annual family income | ≤ 10 lakhs | 41 | 83.7 | 11 | 57.9 | 5.057 | |

| ≥ 10 lakhs | 8 | 16.3 | 9 | 42.1 | 0.03 | ||

Table 2 depicts the health insurance details of the study participants. Most participants chose floater-type policies (63.3% government, 68.4% private), with a significant preference for secondary beneficiary status (62.5% government, 66.7% private). Policies typically had annual premiums under ₹20,000 (63.3% government, 68.4% private) and offered coverage up to ₹5,00,000 (59.2% government, 73.7% private). A significant proportion of participants used their current insurance for the first time (53.1% government, 63.2% private). These findings were statistically significant (p < 0.001).

| Details of health insurance | Variables | Type of VHI company | P value | |||

|---|---|---|---|---|---|---|

| Government (n=49) | Private (n=19) | |||||

| N | % | N | % | |||

| Type of policy | Individual | 18 | 36.7 | 6 | 31.6 | <0.001 |

| Floater | 31 | 63.3 | 13 | 68.4 | ||

| If floater, type of beneficiary (n=44) | Primary | 12 | 37.5 | 8 | 66.7 | <0.001 |

| Secondary | 20 | 62.5 | 4 | 33.3 | ||

| Annual premium | <20,000 INR | 31 | 63.3 | 13 | 68.4 | <0.001 |

| >20,000 INR | 18 | 36.7 | 6 | 31.6 | ||

| Sum insured | Less than 5 lakhs | 29 | 59.2 | 14 | 73.7 | <0.001 |

| More than 5 lakhs | 20 | 40.8 | 5 | 26.3 | ||

| Number of years enrolled | Less than 5 years | 23 | 46.9 | 9 | 47.4 | <0.001 |

| More than 5 years | 26 | 53.1 | 10 | 52.6 | ||

| Number of times admitted in current premium period | Once | 26 | 53.1 | 12 | 63.2 | <0.001 |

| More than once | 23 | 46.9 | 7 | 36.8 | ||

Bold value signifies statistically significant P values.

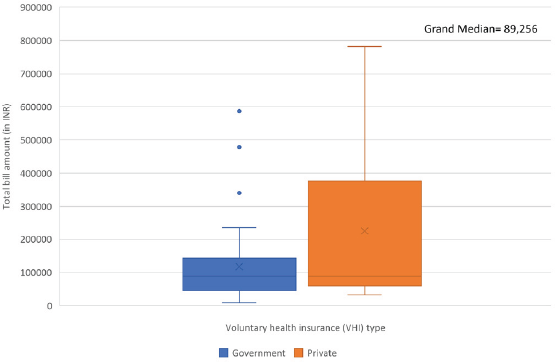

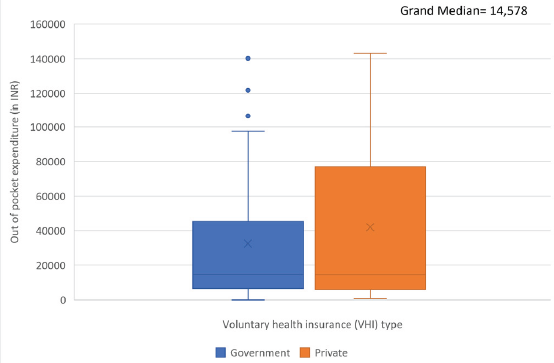

The study analyzed hospital bills and OPE for patients using government and private health insurance. The box and whisker plots in Figures 1 and 2 illustrate the distribution of these costs. Median total hospital bills were similar (₹88,600 vs. ₹88,759), with no significant difference (p = 0.309). Median OPE was also comparable (₹14,675 vs. ₹14,482, p = 0.787). The interquartile ranges (IQR) for both total bills and OPE were similar, indicating consistent cost variability across both insurance types. Overall, approximately 16.3% of the total bill was paid out of pocket, with a consistent percentage across both government and private health insurance. These findings suggest that the choice of insurance provider does not significantly impact these financial aspects of healthcare.

- Box whisker plots represents the median total hospital bill (with interquartile range) for government and private voluntary health insurances (N=68).

- Box whisker plots represents the median OPE (with interquartile range) for government and private voluntary health insurances (N=68). OPE: Out-of-pocket expenditure.

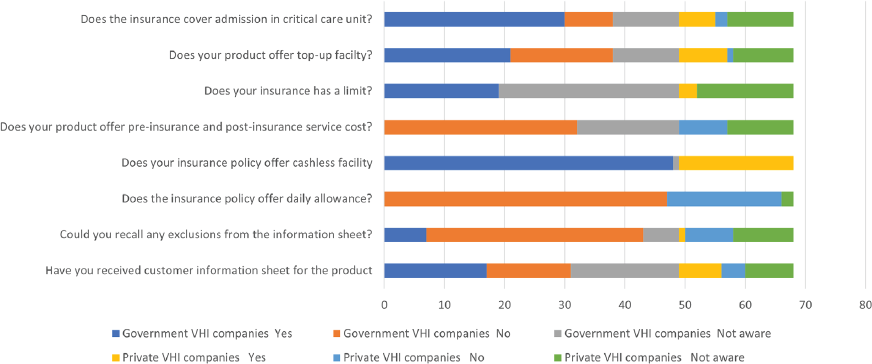

Figure 3 reveals a significant lack of awareness among participants regarding specific aspects of their health insurance policies, both government and private. While almost all participants were familiar with cashless facilities and over half were aware of critical care unit coverage, more than one-third were unaware of top-up facilities, and nearly none knew about daily allowances or pre- and post-insurance service costs. Approximately one-third of policyholders were aware of at least one policy exclusion. Additionally, more than one-fourth of participants did not receive or were unaware of customer information sheets. These findings underscore the need for enhanced communication and education from both government and private health insurance providers to ensure policyholders have a comprehensive understanding of their coverage.

- Patients knowledge about the voluntary health insurance (N=68).

Table 3 depicts a comparison among health insurance companies, including both government and private providers, highlighting various service features. Satisfaction with reimbursement scores were similar between government and private companies, both averaging 4. In contrast, private companies exhibited a slightly higher score for the affordability of health insurance policies, averaging 5 compared to 4 for government companies. Interestingly, the likelihood to recommend the insurance policy showed minimal differences, with government companies averaging 4 and private companies averaging 3.5. Lastly, the effectiveness of customer care services was rated highest by private health insurance companies, averaging 4, followed by government companies at 3. The p-values generated from the Mann-Whitney Test indicate no significant differences in satisfaction with reimbursement (p = 0.455), affordability of health insurance policies (p = 0.288), and likelihood to recommend the insurance policy (p = 0.949), while suggesting a significant difference in the effectiveness of customer care services (p = 0.121).

| Variables | Type of voluntary health insurance (VHI) companies | P Value ** | |

|---|---|---|---|

| Government | Private | ||

| Median score* (IQR) | |||

| Satisfaction with reimbursement | 4 (3-4) | 3 (2-4) | 0.45 |

| Affordability of VHI policy | 4 (3-5) | 5 (3-5) | 0.28 |

| Likeliness to recommend VHI policy | 4 (2-4) | 3 (3-4) | 0.94 |

| Effectiveness of customer care services | 3 (2-4) | 4 (3-4) | 0.12 |

Discussion

The present study indicates that individuals with government-provided VHI are more likely to be male, over 60, and have an annual family income of less than ₹10 lakhs. These findings align with a previous study by Chollet.5 This suggests that government VHI programs may be more accessible to specific demographic groups, such as the elderly and lower-income individuals, consistent with earlier research by Niankara and Patrick et al.6,7 The higher proportion of individuals with comorbidities opting for VHI also aligns with findings from an article by Mathauer et al.8 Regarding occupation, the data indicate that a greater proportion of individuals with government VHI are retired or unemployed. Conversely, a study by Kulberg et al. found that VHI is more common among high-income earners, individuals employed in the private sector, and white-collar workers.9

This study explored potential variations in VHI plans offered by government and private providers. In the present study, more than half of the enrollees in government plans held floater policies. This finding aligns with previous research indicating that floater policies dominate the VHI industry, as they offer coverage for multiple family members.10 The study also reveals that the majority of participants pay an annual premium of less than ₹20,000, consistent with reports from Financial Express and Policybazaar, which state that the average annual premium paid by health insurers in India for a family ranges from ₹10,000 to ₹25,000.11,12 Furthermore, most participants opted for VHI policies offering coverage of up to ₹5 lakh, supporting Acko General Insurance's assertion that VHI policy coverage should be at least ₹5 lakh minimum.13 With the majority of study participants being over 60 years of age, the findings indicate that nearly half of the government voluntary health-insured patients and more than a quarter of the private voluntary health-insured patients were admitted more than once during the same premium period. This aligns with previous research by Pandey et al., which found that the older population in India has a significantly higher hospitalization rate.13

Our findings indicate that despite having voluntary health insurance, more than a quarter of the overall cost is covered through out-of-pocket expenditure. These results align with articles on voluntary health insurance, which state that despite offering substantial support for medical bills, Indian health insurance has limitations.14–16 Coverage varies by plan and provider, and out-of-pocket expenses are likely due to co-payments, sub-limits, and exclusions for pre-existing conditions or specific treatments.

Our study investigated patients' knowledge of health insurance policies, revealing significant gaps in understanding among government and private voluntary health insurance holders. Insurers must enhance their communication strategies to fully inform policyholders about their coverage, benefits, and exclusions. Improved education and transparency can lead to better utilization of insurance policies, increased satisfaction, and greater trust and loyalty among customers, ultimately enhancing customer retention.

In the present study, the overall median satisfaction score for reimbursement and affordability of health insurance products was rated as "Good." This contrasts with a previous study by Garg, which reported a mean satisfaction score of 2.74 for VHI policyholders across public and private hospitals in India; however, the results were not statistically significant in either study.17 Additionally, our study found median scores of 3.5 for the likelihood of recommending the health insurance policy and 3 for the effectiveness of customer care services, again contrasting with Garg's mean satisfaction score of 2.74.17

This study was conducted in a teaching hospital located in a semi-urban area, resulting in lower billing charges compared to private hospitals in urban areas. Additionally, the study could not capture variations in spending due to the severity and complexity of CKD. Indirect costs, such as productivity loss and family-related financial concerns, were not assessed. Despite efforts to conduct interviews without distractions, some patients may have provided inaccurate data regarding insurance and satisfaction due to a lack of privacy and fear of judgment. Furthermore, variations in annual premiums, sums insured, and types of policies among participants may have affected the overall mean OPE. The study also acknowledges the potential for recall bias.

These findings suggest that, despite having VHI, individuals with CKD requiring KRT continue to face a significant financial burden due to limited coverage and out-of-pocket expenses. The research highlights the critical need for enhanced patient education and awareness regarding health insurance plans. A holistic strategy is essential to reduce out-of-pocket expenditures for individuals with CKD who rely on VHI. This comprehensive approach involves empowering patients with educational and advocacy resources to navigate their plans, promoting transparency and personalized support from insurance providers, refining coverage through evidence-based policymaking, and enabling healthcare professionals to assist patients in managing costs and accessing financial aid. By integrating these components, we can address the high out-of-pocket expenditures faced by CKD patients with VHI, ultimately improving their care experience, reducing financial burdens, and enhancing their overall well-being.

Conflicts of interest

There are no conflicts of interest.

References

- Indian social network. 2024. Available from: https://isn-india.org/wp-content/uploads/2024/03/News-Letter.pdf [Last accessed 2024 May 10]

- [Google Scholar]

- Burden of chronic kidney disease in the general population and high-risk groups in South Asia: A systematic review and meta-analysis. PLoS One. 2021;16:e0258494.

- [CrossRef] [PubMed] [PubMed Central] [Google Scholar]

- Gov.in. [cited 2024 Nov 13]. Available from: https://pmndp.mohfw.gov.in/en/introduction-of-pradhan-mantri-national-dialysis-program-pmndp

- Global dialysis perspective: India. Kidney360. 2020;1:1143-7.

- [CrossRef] [PubMed] [PubMed Central] [Google Scholar]

- Consumers, insurers, and market behavior. J Health Polit Policy Law. 2000;25:27-44.

- [CrossRef] [PubMed] [Google Scholar]

- Pooled cross-sectional sample data of the 2015, 2016, 2017 National Health Interview Surveys for studying the determinants of health care market and labor market outcomes in post affordable care act USA. Data Brief. 2018;21:1526-32.

- [CrossRef] [PubMed] [Google Scholar]

- Health Insurance coverage before and after the affordable care act in the USA. Sci. 2021;3:25. Available from: https://www.mdpi.com/2413-4155/3/2/25

- [CrossRef] [Google Scholar]

- Voluntary health insurance: its potentials and limits in moving towards UHC, Policy Brief, Department of Health Systems Governance and Financing. Geneva: World Health Organization; 2018. (WHO/HIS/HGF/PolicyBrief/18.5). Licence: CC BY-NC-SA 3.0 IGO

- Health insurance for the healthy? Voluntary health insurance in Sweden. Health Policy. 2019;123:737-46.

- [CrossRef] [PubMed] [Google Scholar]

- Voluntary health insurance in Europe: Role and regulation. European Observatory on Health Systems and Policies 2016

- [Google Scholar]

- Good News! India is among the cheapest health insurance markets insurance news. Available from: https://www.financialexpress.com/money/insurance-good-news-india-is-among-the-cheapest-health-insurance-markets-1897663/ [last accessed on 20 May 2024].

- Best health insurance plans in India May 2024. Available from: https://www.policybazaar.com/health-insurance/individual-health-insurance/articles/best-health-insurance-plans-in-india/ [last accessed on 20 May 2024].

- Hospitalisation trends in India from serial cross-sectional nationwide surveys: 1995 to 2014. BMJ Open. 2017;7:e014188.

- [CrossRef] [PubMed] [PubMed Central] [Google Scholar]

- Guidelines on Standardisation of Exclusions in Health Insurance Contracts [Internet]. 2015. Available from: https://irdai.gov.in/hi/document-detail?documentId=392498

- Available from: https://www.novabenefits.com/blog/coverage-gaps-understanding-the-limitations-and-exclusions-of-corporate-health-insurance-policies [last accessed on 3 Jun 2024]

- Co-pay in health insurance: Everything you need to know [Internet]. Tataaig.com. TATA AIG; 2023 [cited 2024 Nov 15]. Available from: https://www.tataaig.com/health-insurance/co-pay-in-health-insurance

- Satisfaction and problems of health insurance policyholders in India. Int J Banking, Risk and Insurance. 2013;1

- [Google Scholar]